Before You Apply: Know What Your Credit Score Means

Takeaway

Your credit score plays a huge role in whether you get a mortgage, what kind you qualify for, and how much interest you’ll pay. Aim for 760+ to get the best conventional rate. Scores between 620–760 still qualify but may pay a bit more. Below 620, you’ll likely need an FHA loan. Under 580? Fix that credit before applying.

Score 760–850: No Problem, Best Rates

Once you hit about 760, you’re in the "excellent" range. Lenders see you as very low‑risk and will offer you the best conventional loan rates—no extra fees or rate penalties. Industry experts like Experian confirm that a score of 760 + gets you the lowest interest rates on mortgages. Even Experian says rgar "you generally need a score of 760 or higher to get the best interest rate".

Score 620–759: You’ll Get Approved, But Rates May Be Higher

This range—sometimes split as 620–680 or 680–759—still qualifies for conventional loans. The minimum requirement is about 620, but lenders often prefer 680+ to offer better terms.

Score 580–619: Conventional Is Tough — FHA Is Better

In this "fair" range, conventional loans become hard to get or come with steep rates and requirements. But an FHA loan is designed for you. With a 580+ score, you can get an FHA loan with just 3.5% down. If your score is 500–579, you'll need 10% down. Look here to see the FHA minimums broken down.

Under 580: Pause & Repair

Below 580, you’re in the "tough" range. FHA loans may still be possible—but only with bigger down payments and tougher terms. Under 580 means you should thinking about repairing your score before applying according toBankrate.

Why Scores Matter

Credit scores tell lenders how risky you are. A higher score means better odds of repayment, which earns you lower interest. Lower scores trigger higher rates—or may require you to pay extra fees or mortgage insurance

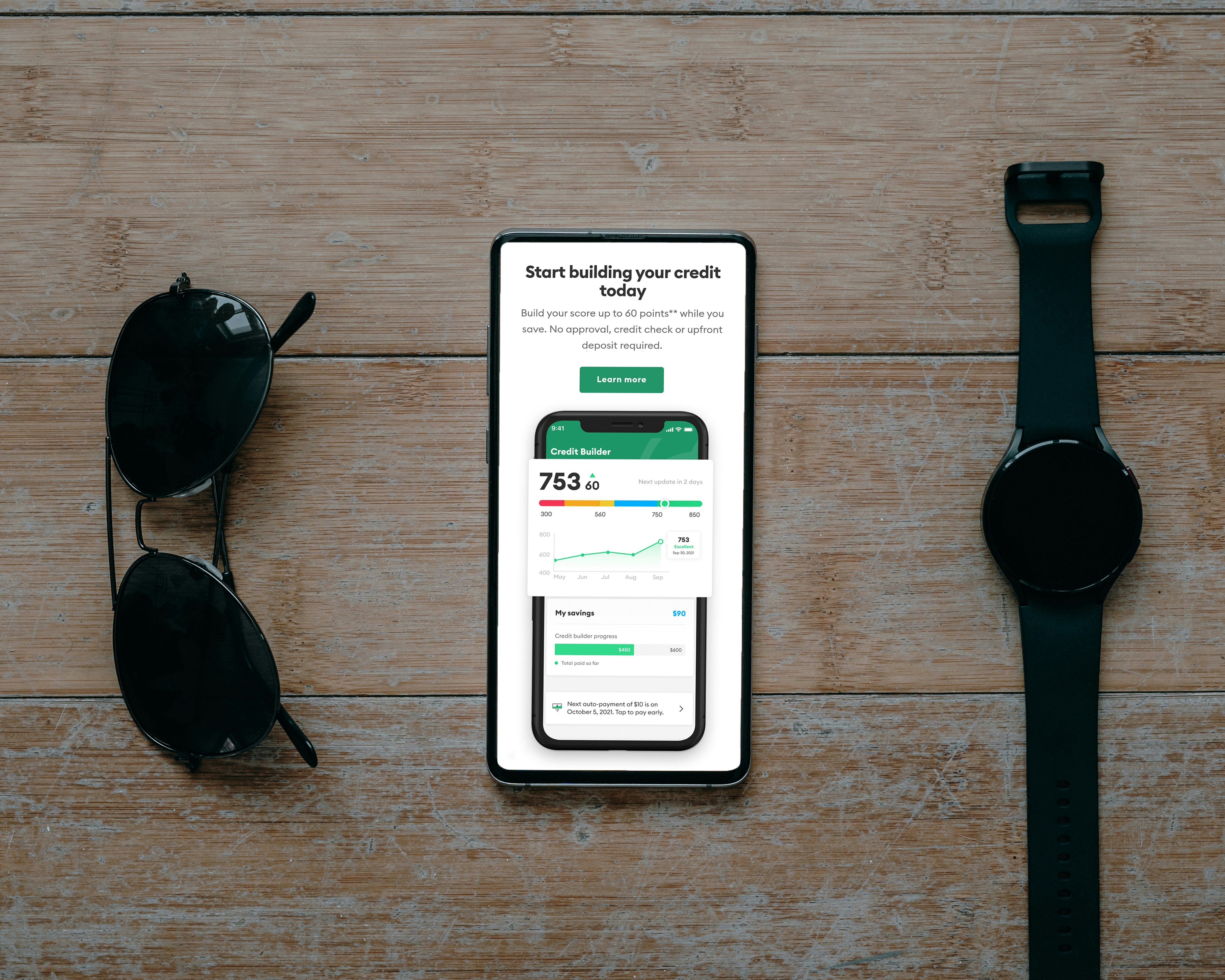

Fixing Your Score

Improve your score by paying bills on time, keeping credit use low, and not opening lots of accounts at once. This helps everyone—whether you're aiming for FHA or conventional Learn more.

Final Word

Ready for a mortgage? Here's what to know:

- 760+, excellent: conventional loan, best interest.

- 620–759, fair to good: conventional possible—expect higher rates until you push closer to 760.

- 580–619, fair: FHA loan is a better, more reliable option.

- <580, poor: fix your credit before applying.

The mortgage rates displayed on this site are collected daily from publicly available sources provided by more than 600 lenders. Mortgage-Rates.ai does not receive compensation for listing these rates, and all rates are presented as published by the respective lenders. While every effort is made to ensure accuracy, the information may contain errors or omissions. Mortgage rates are highly dependent on an individual’s financial circumstances, credit profile, loan terms, and other factors. As such, the rates you are quoted directly by a lender may differ materially from the rates displayed here.

Users should contact lenders directly to obtain formal, binding loan offers. If you identify any discrepancies in the data or would like to have your institution’s rates included, please contact us at content@mortgage-rates.ai

All logos, trademarks, and brand names appearing on this website are the property of their respective owners.

About the author

mortgage-rates.ai