How to Read Your Loan Estimate (Without a Finance Degree)

Quick Takeaway

A Loan Estimate is a three-page form every lender must give you within three days of your mortgage application. It shows your interest rate, monthly payment, and all your closing costs in a standardized format—making it easy to compare offers from different lenders. Some fees on this form are locked in, while others can change. Knowing which is which can save you thousands of dollars.

What Is a Loan Estimate?

When you apply for a mortgage, lenders are required by federal law to give you a Loan Estimate within three business days. This isn't an approval or denial—it's simply a detailed breakdown of what your loan would look like if you move forward.

The best part? Every lender in the country uses the exact same form. That means you can line up offers from Bank A, Credit Union B, and Online Lender C and compare them side by side. The Consumer Financial Protection Bureau (CFPB) designed this form specifically to help you shop smarter.

To get a Loan Estimate, you only need to provide six pieces of information: your name, income, Social Security number, the property address, the home's estimated value, and how much you want to borrow.

Page 1: Your Loan at a Glance

The first page gives you the big picture. Here's what you'll see:

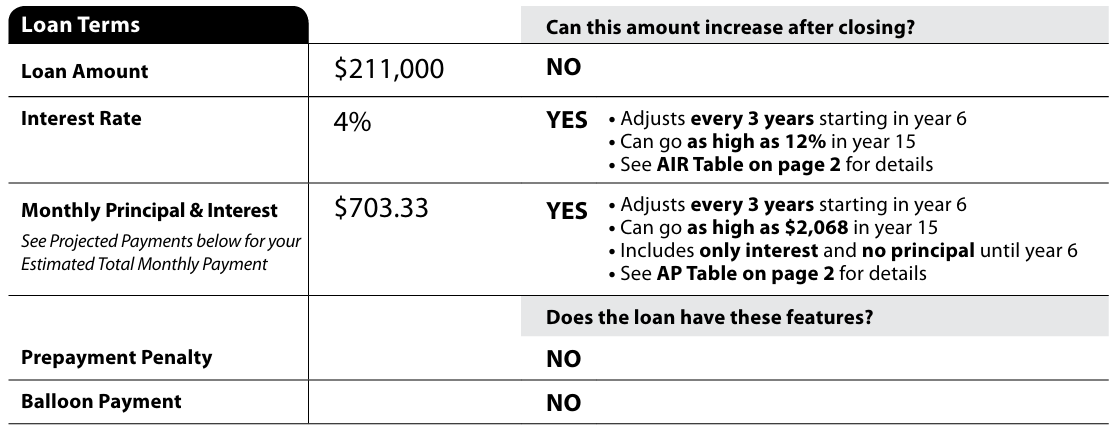

Loan Terms Box

This section shows your loan amount, interest rate, and monthly principal and interest payment. Pay close attention to the column on the right that asks "Can this amount increase after closing?" If you see "YES" next to the interest rate, you're looking at an adjustable-rate mortgage (ARM), which means your rate can change over time.

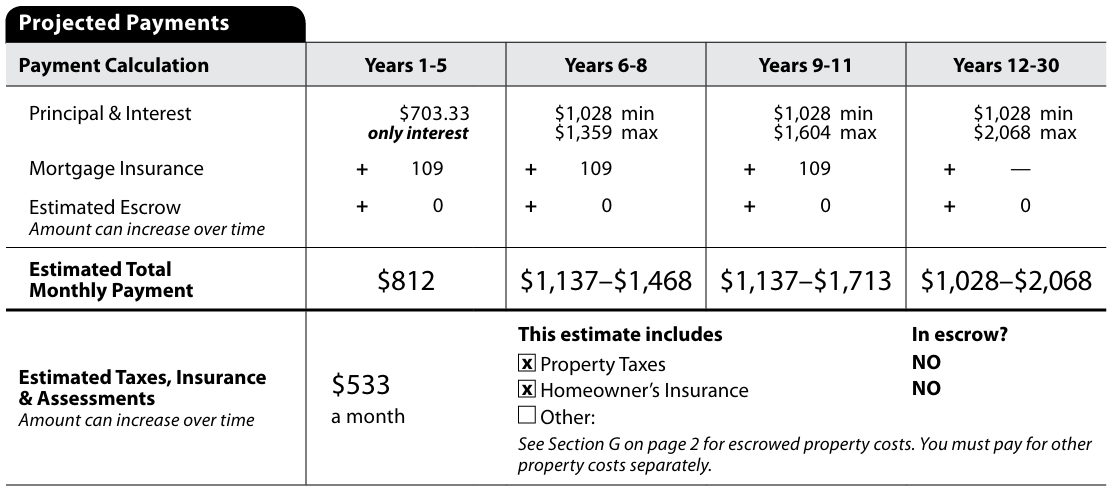

Projected Payments

This breaks down what you'll actually pay each month. It includes:

- Principal and interest (the core loan payment)

- Mortgage insurance (if your down payment is less than 20%)

- Estimated escrow (property taxes and homeowner's insurance bundled together)

The "Estimated Total Monthly Payment" is the number that matters most for your budget. Make sure you can comfortably afford this amount.

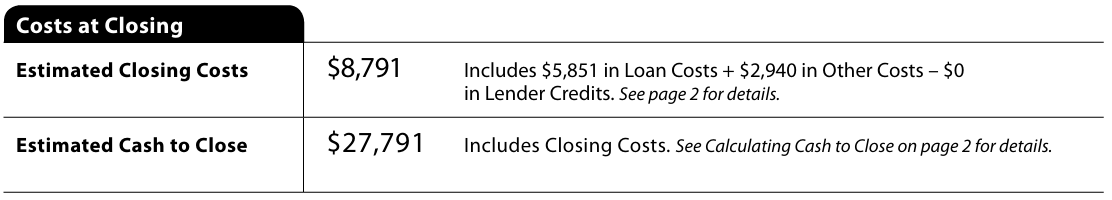

Costs at Closing

At the bottom of page 1, you'll see two key numbers: your estimated closing costs and your estimated cash to close. The cash to close is the total amount you need to bring on closing day—this includes your down payment plus closing costs, minus any deposits you've already made.

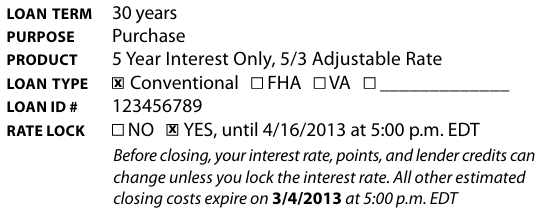

Rate Lock Status

Check the top right corner to see if your rate is locked. If it says "NO," your rate can change before closing. If it says "YES," it will show you until what date the lock is good for. A rate lock protects you from rate increases while your loan is being processed.

Page 2: The Fee Breakdown

Page 2 is where things get detailed. This is your roadmap to understanding exactly where your money goes. The CFPB's interactive Loan Estimate tool can help you understand each line item.

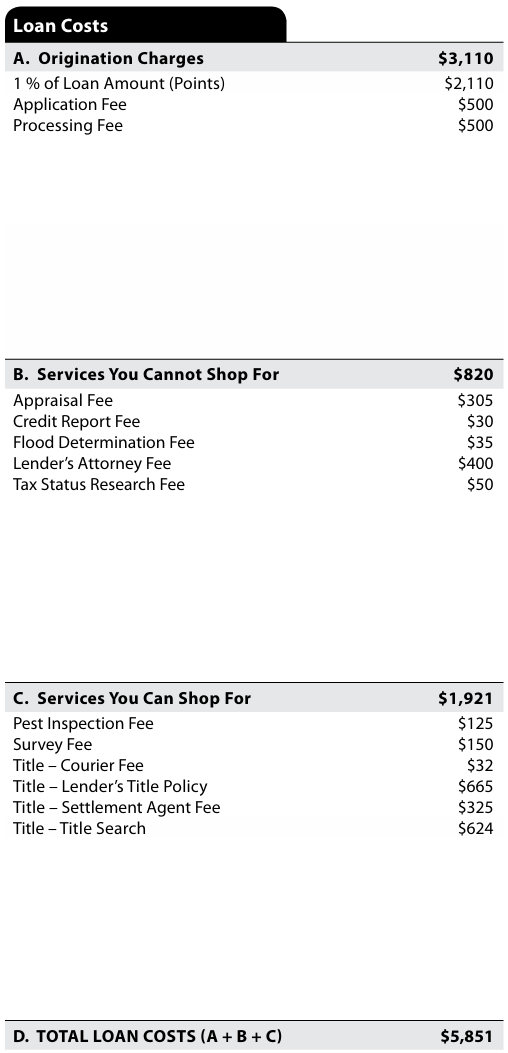

Section A: Origination Charges

These are fees the lender charges you directly for creating the loan. This section typically includes:

- Application fees

- Origination fees (sometimes a flat fee, sometimes a percentage of your loan)

- Underwriting fees

- Processing fees

- Points (optional upfront payments to lower your rate)

Important: These fees vary significantly between lenders. When comparing Loan Estimates, the total in Section A is one of the most important numbers to compare. A lender might advertise a low rate but make up for it with high origination fees.

Section B: Services You Cannot Shop For

These are third-party services required by your lender where you don't get to pick the provider. Common examples include:

- Appraisal fee ($400–$700 typical)

- Credit report fee ($50–$100)

- Flood determination fee

- Tax service fee

While you can't choose these vendors, you can compare these costs between lenders. Some lenders negotiate better rates with their partners.

Section C: Services You Can Shop For

Here's where you have power. You can choose your own providers for these services:

- Title search and title insurance

- Settlement agent or closing attorney

- Survey (if required)

Your lender must give you a written list of approved providers, but you're not limited to that list. Shopping around for these services can save you hundreds of dollars. Title insurance alone can vary by $500 or more between providers.

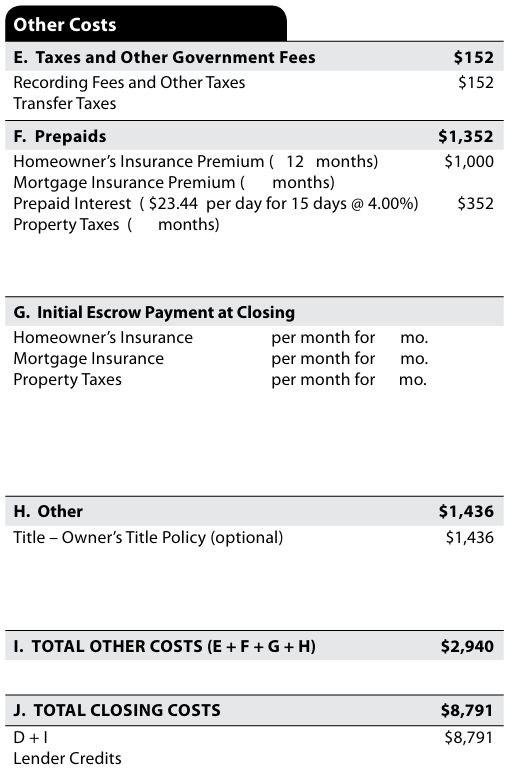

Sections E Through H: Other Costs

These include:

- Recording fees and transfer taxes (set by your local government)

- Prepaid items (interest from closing to month-end, first year of homeowner's insurance)

- Initial escrow deposits (money set aside for future tax and insurance payments)

Lender Credits

If you see a negative number at the bottom of page 2, that's money the lender is giving you to offset closing costs. This usually means you're paying a slightly higher interest rate in exchange for lower upfront costs. It's not free money—you'll pay more over the life of the loan—but it can help if you're short on cash at closing.

Page 3: Comparisons and Fine Print

The third page helps you see the bigger picture and understand important loan features.

Comparisons Section

This gives you three numbers to compare across lenders:

- In 5 Years: Total you'll have paid in five years (principal, interest, mortgage insurance, and loan costs)

- Annual Percentage Rate (APR): Your interest rate plus loan costs, expressed as a yearly rate. This is useful for comparing the true cost of different loans.

- Total Interest Percentage (TIP): How much interest you'll pay over the full loan term as a percentage of your loan amount

Other Considerations

Watch for these items carefully:

- Prepayment Penalty: Does the lender charge you for paying off your loan early? Most modern loans don't have this, but always check.

- Balloon Payment: Will you owe a large lump sum at the end of the loan? This is rare but risky.

- Assumption: Can someone take over your loan if you sell the house?

Which Fees Can Change Before Closing?

Not all fees on your Loan Estimate are final. According to the CFPB, fees fall into three categories:

Fees That Cannot Increase (Zero Tolerance)

- Lender's origination fees

- Points you're paying

- Fees paid to the lender or their affiliates

- Transfer taxes

These fees are locked in. If they go up at closing (without a valid "change in circumstances"), you're entitled to a refund.

Fees That Can Increase by Up to 10% (10% Tolerance)

- Recording fees

- Services where you picked a provider from the lender's list

The total of all fees in this category can't go up by more than 10%. If you're charged more, you get a refund at closing.

Fees That Can Change by Any Amount (No Tolerance)

- Prepaid interest

- Homeowner's insurance premiums

- Initial escrow deposits

- Services where you shopped outside the lender's list

- Optional services not required by the lender

When All Bets Are Off

If there's a "change in circumstances"—like your credit score drops, the appraisal comes in low, or you change the loan amount—the lender can issue a revised Loan Estimate with different fees. Always ask why if you receive a revised estimate.

How to Compare Loan Estimates Like a Pro

When comparing offers from multiple lenders:

- Compare Section A totals first: This is where lenders differ most.

- Look at the APR, not just the rate: The APR includes fees and gives a truer picture of your cost.

- Watch for points: A low rate might come with expensive points that increase your upfront costs.

- Check lender credits: Are they offering money toward closing costs? That affects your true rate.

- Ignore Section C when comparing lenders: You can shop for these services yourself, so they shouldn't influence which lender you choose.

What to Do Next

Once you have your Loan Estimate, you have three main jobs:

1. Verify the basics: Is your name spelled correctly? Is the loan amount right? Does the loan type match what you discussed?

2. Get more estimates: Apply with at least three lenders. You can do this within a 45-day window without additional hits to your credit score.

3. Shop for services: Get quotes for title insurance and settlement services. Even small savings add up.

You can explore the CFPB's interactive Loan Estimate explainer to see exactly what each section means. And remember: receiving a Loan Estimate doesn't mean you're committed to that lender. You're not locked in until you sign your final closing documents.

Understanding your Loan Estimate puts you in control of one of the biggest financial decisions you'll ever make. Take your time, ask questions, and don't be afraid to negotiate.

The mortgage rates displayed on this site are collected daily from publicly available sources provided by more than 600 lenders. Mortgage-Rates.ai does not receive compensation for listing these rates, and all rates are presented as published by the respective lenders. While every effort is made to ensure accuracy, the information may contain errors or omissions. Mortgage rates are highly dependent on an individual’s financial circumstances, credit profile, loan terms, and other factors. As such, the rates you are quoted directly by a lender may differ materially from the rates displayed here.

Users should contact lenders directly to obtain formal, binding loan offers. If you identify any discrepancies in the data or would like to have your institution’s rates included, please contact us at content@mortgage-rates.ai

All logos, trademarks, and brand names appearing on this website are the property of their respective owners.

About the author

mortgage-rates.ai