Is a 50-Year Mortgage Worth It? We Calculated 3 Scenarios So You Don't Have To

Quick Takeaway

A 50-year mortgage could save you about $113 to $452 per month depending on your home price. Sounds great, right? Here's the catch: you'll pay roughly double the interest over the life of the loan. On a $500K home, that's an extra $518,000. On a $2M home? Over $2 million more in interest. We ran the numbers three ways so you can see exactly what you're trading.

How We Built This Analysis

Before we dive into the numbers, let's talk about the elephant in the room: what interest rate would a 50-year mortgage actually carry?

A 50-year mortgage doesn't exist yet as a mainstream product, so we had to estimate the rate. Here's our logic:

Right now, the 15-year fixed mortgage averages about 5.51%, while the 30-year sits at 6.23%. That's a spread of roughly 0.72% for adding 15 years to your loan term. Housing industry analyst Logan Mohtashami at HousingWire estimates a government-backed 50-year mortgage would carry rates between 0.42% and 0.57% higher than a 30-year — and that's the best case scenario.

For our analysis, we used:

- 30-Year Fixed: 6.175% (current market average)

- 50-Year Fixed: 6.75% (30-year rate + 0.575% premium)

This is actually a conservative estimate. Without government backing, rates could be significantly higher since lenders take on more risk over 50 years.

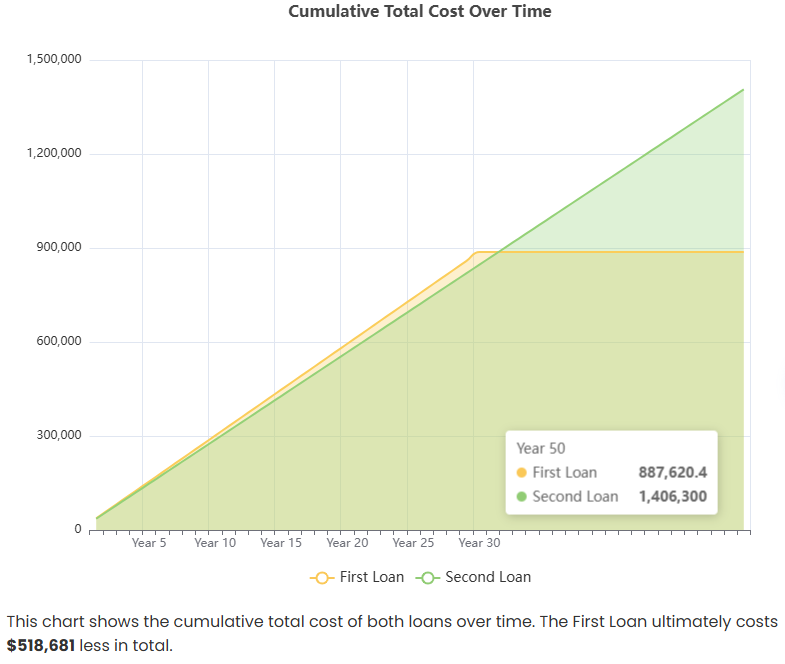

Scenario 1: The $500K Starter Home

Home Price: $500,000 | Down Payment: $100,000 (20%) | Loan Amount: $400,000

| What You'll Pay | 30-Year | 50-Year | Difference |

|---|---|---|---|

| Monthly Payment (Principal & Interest) | $2,443 | $2,331 | You save $113/mo |

| Total Interest Over Life of Loan | $479,621 | $998,302 | You pay $518,681 MORE |

| Total Cost (with $8K closing fees) | $887,621 | $1,406,302 | $518,681 more |

The Trade-Off: You save $113 per month but pay $518,681 more over the life of the loan. That monthly savings would take 383 years to offset the extra interest cost. Not a great deal.

How Your Equity Builds:

| Years Into Loan | 30-Year Equity | 50-Year Equity | You're Behind By |

|---|---|---|---|

| After 5 years | $26,987 | $5,726 | $21,260 |

| After 10 years | $63,706 | $13,744 | $49,962 |

| After 15 years | $113,668 | $24,969 | $88,698 |

| After 20 years | $181,648 | $40,686 | $140,962 |

Note: This is principal paid only, not including your $100K down payment or any home appreciation.

Calculator URL: View Interactive Comparison

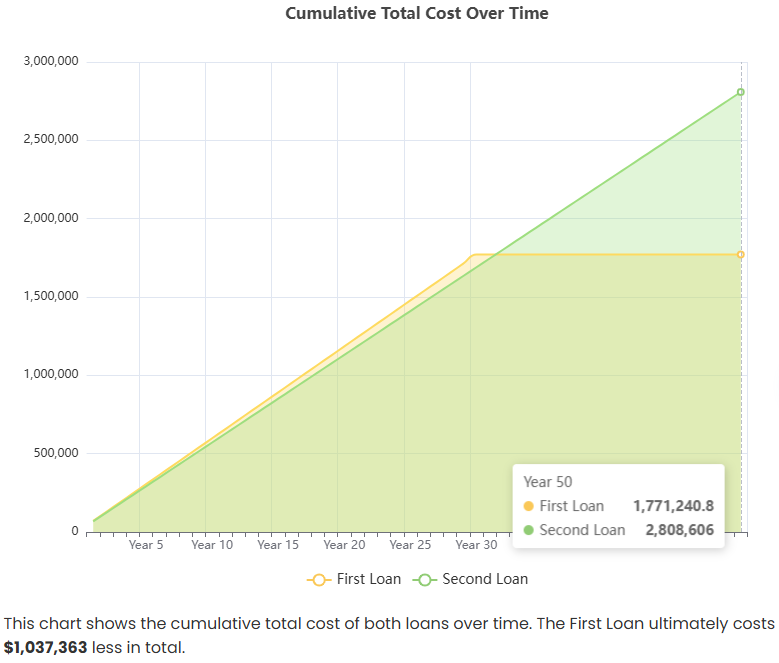

Scenario 2: The $1 Million Move-Up Home

Home Price: $1,000,000 | Down Payment: $200,000 (20%) | Loan Amount: $800,000

| What You'll Pay | 30-Year | 50-Year | Difference |

|---|---|---|---|

| Monthly Payment (Principal & Interest) | $4,887 | $4,661 | You save $226/mo |

| Total Interest Over Life of Loan | $959,241 | $1,996,604 | You pay $1,037,363 MORE |

| Total Cost (with $12K closing fees) | $1,771,241 | $2,808,604 | $1,037,363 more |

The Trade-Off: Yes, you save $226 per month. But you'll pay over $1 million more in interest. The 50-year option costs you nearly double in total interest payments.

How Your Equity Builds:

| Years Into Loan | 30-Year Equity | 50-Year Equity | You're Behind By |

|---|---|---|---|

| After 5 years | $53,973 | $11,453 | $42,521 |

| After 10 years | $127,412 | $27,488 | $99,924 |

| After 15 years | $227,335 | $49,938 | $177,397 |

| After 20 years | $363,296 | $81,372 | $281,923 |

Calculator URL: View Interactive Comparison

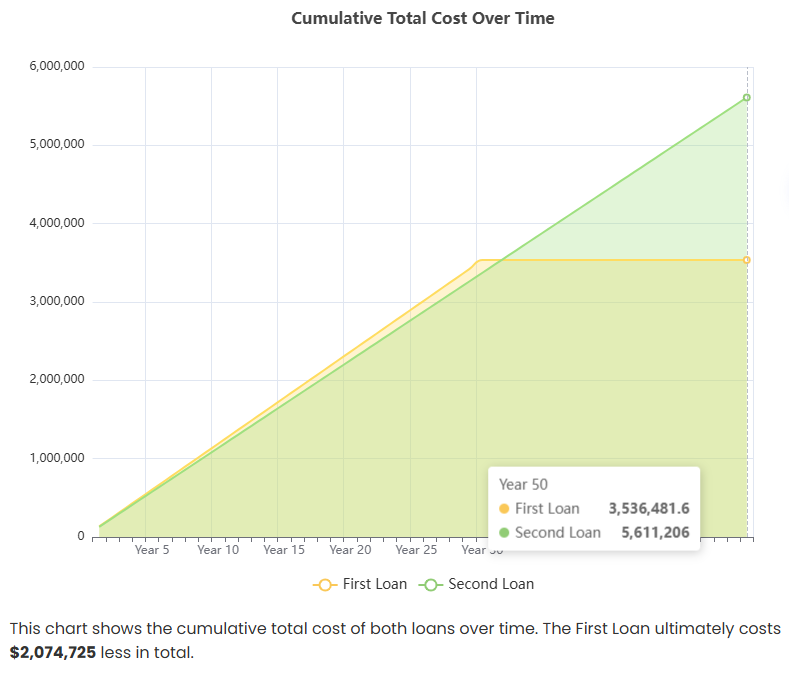

Scenario 3: The $2 Million Dream Home

Home Price: $2,000,000 | Down Payment: $400,000 (20%) | Loan Amount: $1,600,000

| What You'll Pay | 30-Year | 50-Year | Difference |

|---|---|---|---|

| Monthly Payment (Principal & Interest) | $9,774 | $9,322 | You save $452/mo |

| Total Interest Over Life of Loan | $1,918,482 | $3,993,208 | You pay $2,074,725 MORE |

| Total Cost (with $18K closing fees) | $3,536,482 | $5,611,208 | $2,074,725 more |

The Trade-Off: At the luxury level, you save $452 per month but pay over $2 million more in total interest. With a 50-year mortgage on a $2M home, you'd pay nearly $4 million in interest alone — more than double what you'd pay with a 30-year.

How Your Equity Builds:

| Years Into Loan | 30-Year Equity | 50-Year Equity | You're Behind By |

|---|---|---|---|

| After 5 years | $107,947 | $22,905 | $85,041 |

| After 10 years | $254,823 | $54,975 | $199,848 |

| After 15 years | $454,670 | $99,877 | $354,794 |

| After 20 years | $726,591 | $162,744 | $563,847 |

Calculator URL: View Interactive Comparison

The Big Picture: What 96.5% Really Means

Here's a number that should stop you in your tracks: with a 50-year mortgage, 96.5% of your first year's payments go straight to interest. Compare that to 84.2% with a 30-year loan.

In practical terms, if you have a $400,000 loan:

- 30-Year: You pay about $24,700 in interest your first year and $4,621 goes toward your principal

- 50-Year: You pay about $27,000 in interest your first year and only $966 goes toward your principal

That's not a typo. With a 50-year mortgage, you'd build less than $1,000 in equity from your first year of payments on a $400K loan. The rest — nearly $28,000 — goes directly to the bank.

Quick Comparison Summary

| Home Price | 30-Year Payment | 50-Year Payment | Monthly Savings | Extra Interest You'll Pay |

|---|---|---|---|---|

| $500,000 | $2,443 | $2,331 | $113 | $518,681 |

| $1,000,000 | $4,887 | $4,661 | $226 | $1,037,363 |

| $2,000,000 | $9,774 | $9,322 | $452 | $2,074,725 |

Across all scenarios, the interest multiplier is roughly 2.08x — you pay more than double the interest with a 50-year mortgage compared to a 30-year.

The Pros and Cons Laid Bare

Potential Benefits of a 50-Year Mortgage:

- Lower monthly payment: About 4.6% lower than a 30-year — roughly $113 to $452 depending on home price

- May help you qualify: The lower payment could push your debt-to-income ratio into approval territory

- Flexibility: You can always pay extra when you have it (though few people actually do this consistently)

- If you move quickly: If you sell or refinance within 7-10 years (which most borrowers do), the extra interest doesn't fully accumulate

The Real Costs of a 50-Year Mortgage:

- You pay 2x the interest: On every scenario we tested, total interest roughly doubled

- Painfully slow equity: After 10 years, you've built about 1/5 the equity you would with a 30-year

- Higher underwater risk: With so little equity, any price dip could leave you owing more than your home is worth

- Higher rate: You'll likely pay 0.5% to 0.75% more in interest rate on top of the longer term

- Debt until old age: If you're 35 when you buy, you'd be paying until 85 — and if you're 40 (the current average first-time buyer age), you'd be 90

When Might a 50-Year Mortgage Actually Make Sense?

Despite the scary numbers, there are some situations where a 50-year mortgage might be a reasonable choice:

- You're certain you'll sell or refinance within 5-7 years: If you're buying a "starter home" you know you'll outgrow, the lower payment could help you get in the door without the full interest penalty

- The alternative is renting indefinitely: Even with terrible terms, building some equity beats building none

- You have a solid plan to pay extra: If you genuinely commit to making 30-year equivalent payments when possible, you get flexibility without the full cost

- Your income is about to jump: Early-career professionals who expect significant salary increases might benefit from lower payments now with plans to refinance later

The Bottom Line

A 50-year mortgage saves you about 4.6% on your monthly payment while costing you roughly double in total interest. For most buyers, that's a bad trade.

The monthly savings of $113 to $452 sounds nice, but it's not the game-changer some politicians claim. If $113/month is the difference between affording a home or not, you might be stretching beyond what you can truly afford.

That said, mortgages aren't one-size-fits-all. If you understand the trade-offs and have a clear exit strategy, a 50-year mortgage could be a tool — just a very expensive one.

Ready to run your own numbers? Try our Mortgage Comparison Calculator to see exactly how different terms and rates affect your specific situation.

Related Reading

The mortgage rates displayed on this site are collected daily from publicly available sources provided by more than 600 lenders. Mortgage-Rates.ai does not receive compensation for listing these rates, and all rates are presented as published by the respective lenders. While every effort is made to ensure accuracy, the information may contain errors or omissions. Mortgage rates are highly dependent on an individual’s financial circumstances, credit profile, loan terms, and other factors. As such, the rates you are quoted directly by a lender may differ materially from the rates displayed here.

Users should contact lenders directly to obtain formal, binding loan offers. If you identify any discrepancies in the data or would like to have your institution’s rates included, please contact us at content@mortgage-rates.ai

All logos, trademarks, and brand names appearing on this website are the property of their respective owners.

About the author

mortgage-rates.ai