Mortgage Articles

Simple Guides to Help You Get Your Mortgage

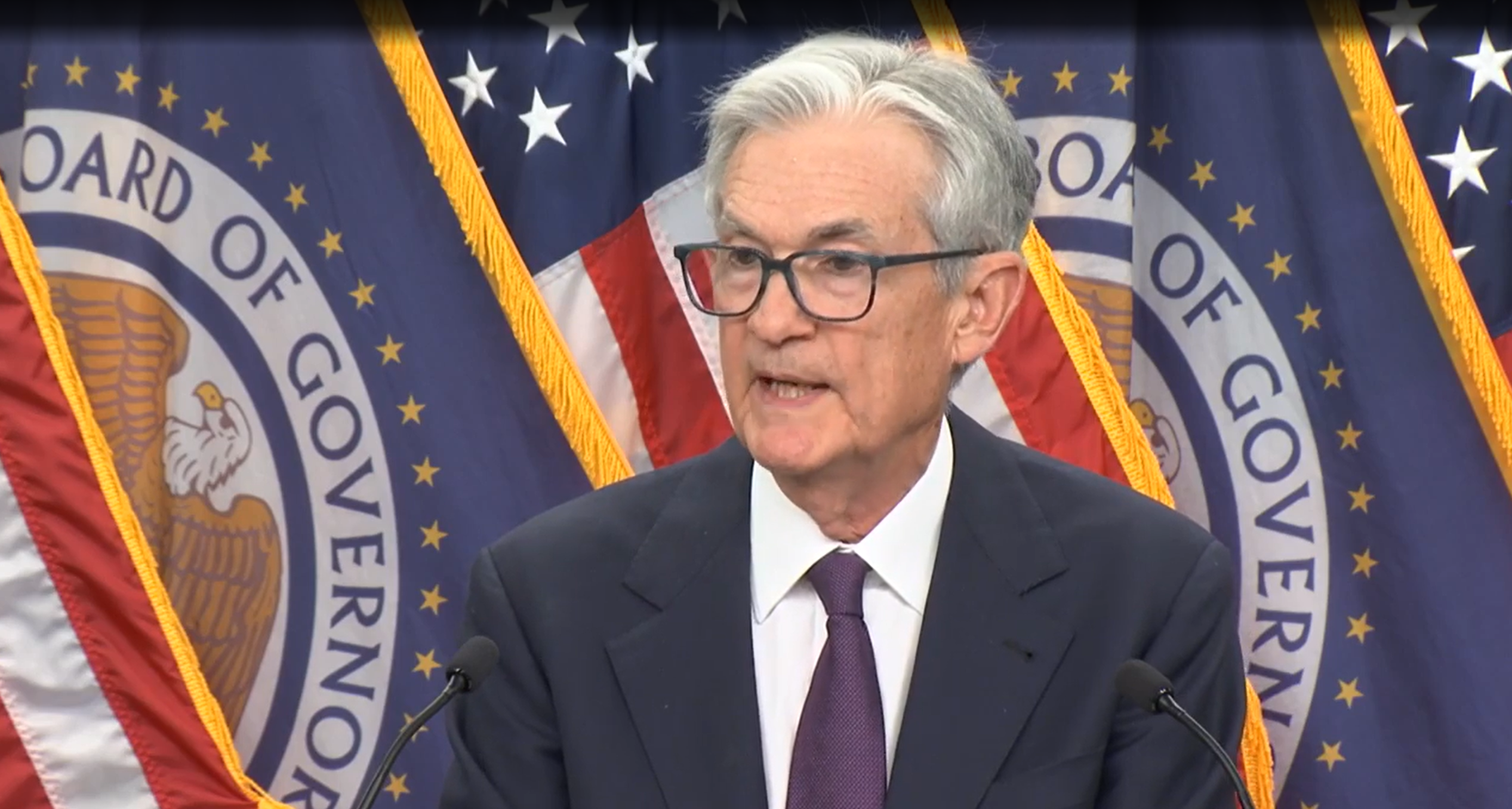

Mortgage Rates May Stick Around—Here’s Why

📌 Key Takeaways

- 📉 The Fed held rates steady but hinted at fewer cuts this year.

- 💸 That means mortgage rates may stay higher for longer.

- 📊 Rates are still moving daily, so shopping around matters more than ever.

💬 Summary

Mortgage rates won’t fall as fast as many had hoped, thanks to the Fed’s cautious tone on inflation.

🚨 Don’t Count on Quick Relief

Yesterday, the Federal Reserve chose to leave interest rates unchanged. But here’s the real headline: they’re only expecting one rate cut this year instead of the three they talked about earlier in 2024. That cools off hopes for cheaper loans anytime soon.

📈 What That Means for Mortgage Rates

Mortgage rates don’t move in lockstep with the Fed’s decision, but they take cues. Since the Fed’s main job is to fight inflation, mortgage lenders watch closely. If the Fed is staying cautious, lenders are less likely to lower rates. Bottom line? Expect mortgage rates to stick around the 6.5%–7.5% range for a bit.

💡 Should You Wait to Buy?

Waiting for big rate drops might not pay off. Even the latest Freddie Mac average shows only slight movement week to week. If the right house pops up and your budget works, it might still be the right time.

🛍️ Why It Still Pays to Shop Around

Even in a high-rate environment, comparing lenders could save you thousands. According to a CFPB study, borrowers who compare multiple quotes often get much better deals.

The mortgage rates displayed on this site are collected daily from publicly available sources provided by more than 600 lenders. Mortgage-Rates.ai does not receive compensation for listing these rates, and all rates are presented as published by the respective lenders. While every effort is made to ensure accuracy, the information may contain errors or omissions. Mortgage rates are highly dependent on an individual’s financial circumstances, credit profile, loan terms, and other factors. As such, the rates you are quoted directly by a lender may differ materially from the rates displayed here.

Users should contact lenders directly to obtain formal, binding loan offers. If you identify any discrepancies in the data or would like to have your institution’s rates included, please contact us at content@mortgage-rates.ai

All logos, trademarks, and brand names appearing on this website are the property of their respective owners.

About the author

mortgage-rates.ai