Stop Guessing: How to Tell if You're Getting a Fair Mortgage Rate

The Bottom Line

Getting a good mortgage rate isn't about luck – it's about understanding where your rate falls compared to others and shopping around. While benchmarks give you a starting point, your personal situation drives your actual rate. Use rate distribution charts to see where you stack up and always, always get at least 3 quotes before making a decision.

Looking at Benchmarks: Your Starting Point

When you get a mortgage quote, your first question is probably "Is this any good?" That's where benchmarks come in. Think of them as the average of what's happening in the mortgage world right now.

You've got several big players tracking mortgage rates. First up is our benchmark at mortgage-rates.ai. We track real rates from actual lenders every day, giving you a clear picture of what's happening in the market right now. You can find it right on our home page – no digging required.

Then there's Freddie Mac – they've been keeping tabs on rates since 1971. Their weekly survey shows what rates look like for people with perfect credit who put 20% down.

Mortgage News Daily updates every single day. They pull real data from actual lender rate sheets, so you get a fresh look at where rates stand.

Another one is OBMMI (Optimal Blue Mortgage Market Indices). This tracks actual locked rates from about one-third of all mortgages in America. That means real people getting real loans, not just estimates.

Why Benchmarks Don't Tell the Whole Story

Here's the thing – benchmarks are just one piece of the puzzle. They show you an average, but your rate is all about YOU. Your credit score, how much you're putting down, your income, your debts, and even your zip code all matter.

Someone with a 780 credit score putting 20% down will get a way better rate than someone with a 640 score putting 5% down. That benchmark you see? It might not apply to your situation at all.

The Game-Changer: Our Rate Distribution Chart

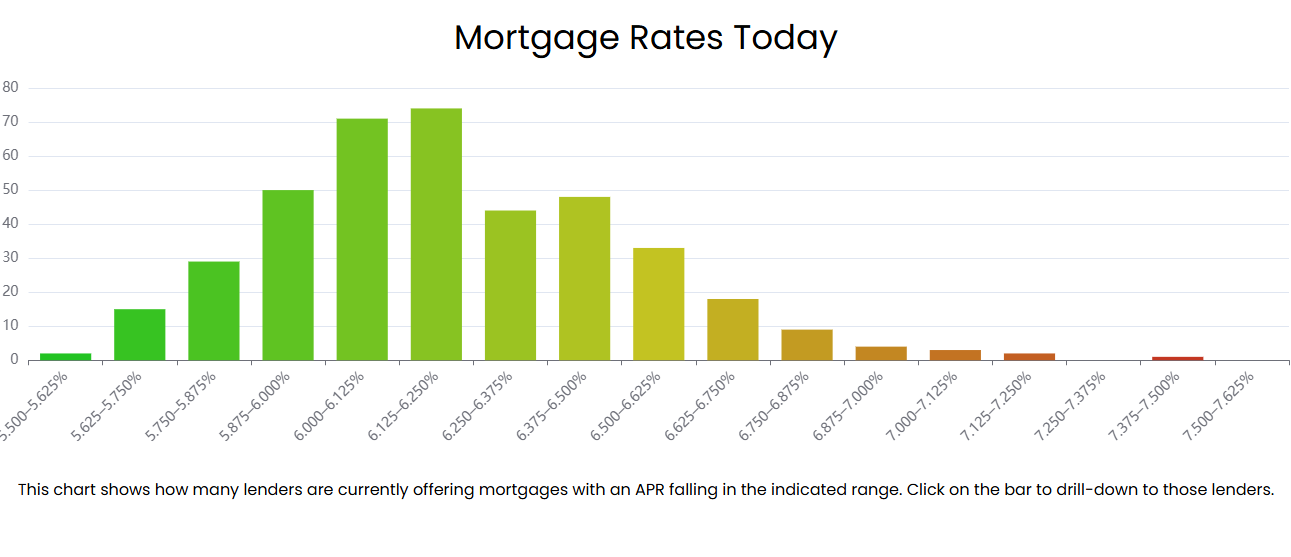

This is where things get interesting. Right on our home page at mortgage-rates.ai, you'll find our rate distribution chart. This powerful tool shows you exactly how many lenders fall into each rate range – broken down by 1/8 of a percentage point. Even better, you can see which specific lenders are offering what rates.

Picture this: You get a quote for 6.5%. Our benchmark says 6.25%. You might think you're getting ripped off. But then you look at our distribution chart and see that for someone with your credit score and down payment, most lenders are actually at 6.625% or higher. Suddenly, your quote looks pretty good!

Our chart gives you the bird's eye view of where your rate sits on the spectrum. You can see if you're getting one of the best rates available or if you should keep shopping. No more guessing – you'll know exactly where you stand compared to what's really out there.

The Golden Rule: Get At Least 3 Quotes

Here's something that might blow your mind – getting just one extra quote could save you $1,500 over the life of your loan. Get five quotes? You could save around $3,000.

Why such a big difference? Every lender has their own secret sauce for setting rates. Some might love your type of property. Others might give better deals for certain credit scores. You won't know until you ask.

The best part? All your credit checks within 45 days count as just one inquiry on your credit report. So you can shop around without trashing your credit score.

How to Shop Smart

Start by getting your paperwork together – pay stubs, tax returns, bank statements. Then hit up at least 3 lenders, but 5 is even better. Make sure you're comparing apples to apples – same loan amount, same type of mortgage, same down payment.

Don't be shy about playing lenders against each other. Got a better quote from Lender A? Show it to Lender B and ask if they can beat it. This negotiation could save you thousands.

Look beyond just the interest rate too. Check out closing costs, points, and any weird fees. Sometimes the lowest rate comes with the highest fees, and that's not always a good deal.

The Bottom Line

A good mortgage quote is one that beats most other lenders for YOUR specific situation. Don't just compare to benchmarks – use rate distribution charts to see the full picture, and always get multiple quotes. Remember, even a small difference in your rate can mean huge savings over 30 years. Take the time to shop around. Your future self will thank you.

The mortgage rates displayed on this site are collected daily from publicly available sources provided by more than 600 lenders. Mortgage-Rates.ai does not receive compensation for listing these rates, and all rates are presented as published by the respective lenders. While every effort is made to ensure accuracy, the information may contain errors or omissions. Mortgage rates are highly dependent on an individual’s financial circumstances, credit profile, loan terms, and other factors. As such, the rates you are quoted directly by a lender may differ materially from the rates displayed here.

Users should contact lenders directly to obtain formal, binding loan offers. If you identify any discrepancies in the data or would like to have your institution’s rates included, please contact us at content@mortgage-rates.ai

All logos, trademarks, and brand names appearing on this website are the property of their respective owners.

About the author

mortgage-rates.ai